Is Now The Time To Buy Gold?

“Long-term investors are now interested in holding gold because rates are lower, At the same time, central banks holdings are probably still going to pile up.” Goldman Sachs Research analyst - Lina Thomas

Gold is forecast to climb higher than previously expected as central banks in emerging markets have ramped up purchases, according to Goldman Sachs Research.

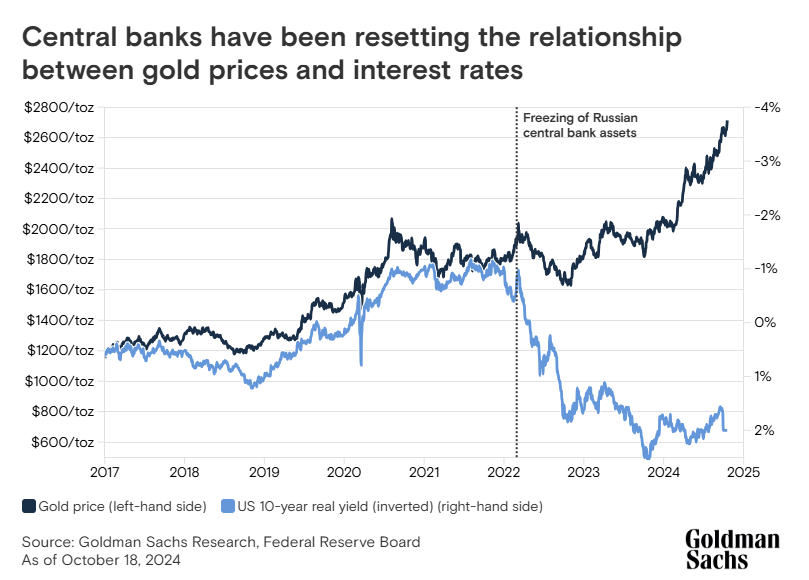

Gold usually trades closely in line with interest rates. As an asset that doesn’t offer any yield, it typically becomes less attractive to investors when interest rates are higher, and it’s usually more desirable when rates fall. While that relationship still holds, central bank purchases have been a powerful force, resetting the level of gold prices higher since 2022, Goldman Sachs Research analyst Lina Thomas writes in her team’s report.

So should you buy gold now… or wait?

Central bank digital currencies are getting traction…

Foreign nations (like BRICS countries) are abandoning the US dollar…

Dysfunctional politics are pummeling the markets…

The national debt’s over $34 trillion and climbing daily…

The banking system is at risk of crumbling…

And Central Banks have now bought over 1,000 tons of gold.

It seems like something BIG is coming, but should you get into gold now?

You’ll see how to buy gold, and you’ll even see how to think about buying gold.

Don't sit idle while your hard work retirement savings are losing value. Get the free Gold IRA guide and discover how to protect yourself.